New Tax Credit For Children 2024 Social Security

New Tax Credit For Children 2024 Social Security – A deal between two influential politicians — a Democrat and a Republican — could have ramifications in this year’s tax season. . Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. .

New Tax Credit For Children 2024 Social Security

Source : www.investopedia.com

Child Tax Credit 2024: Easy guide to your credit for dependents:

Source : www.usatoday.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

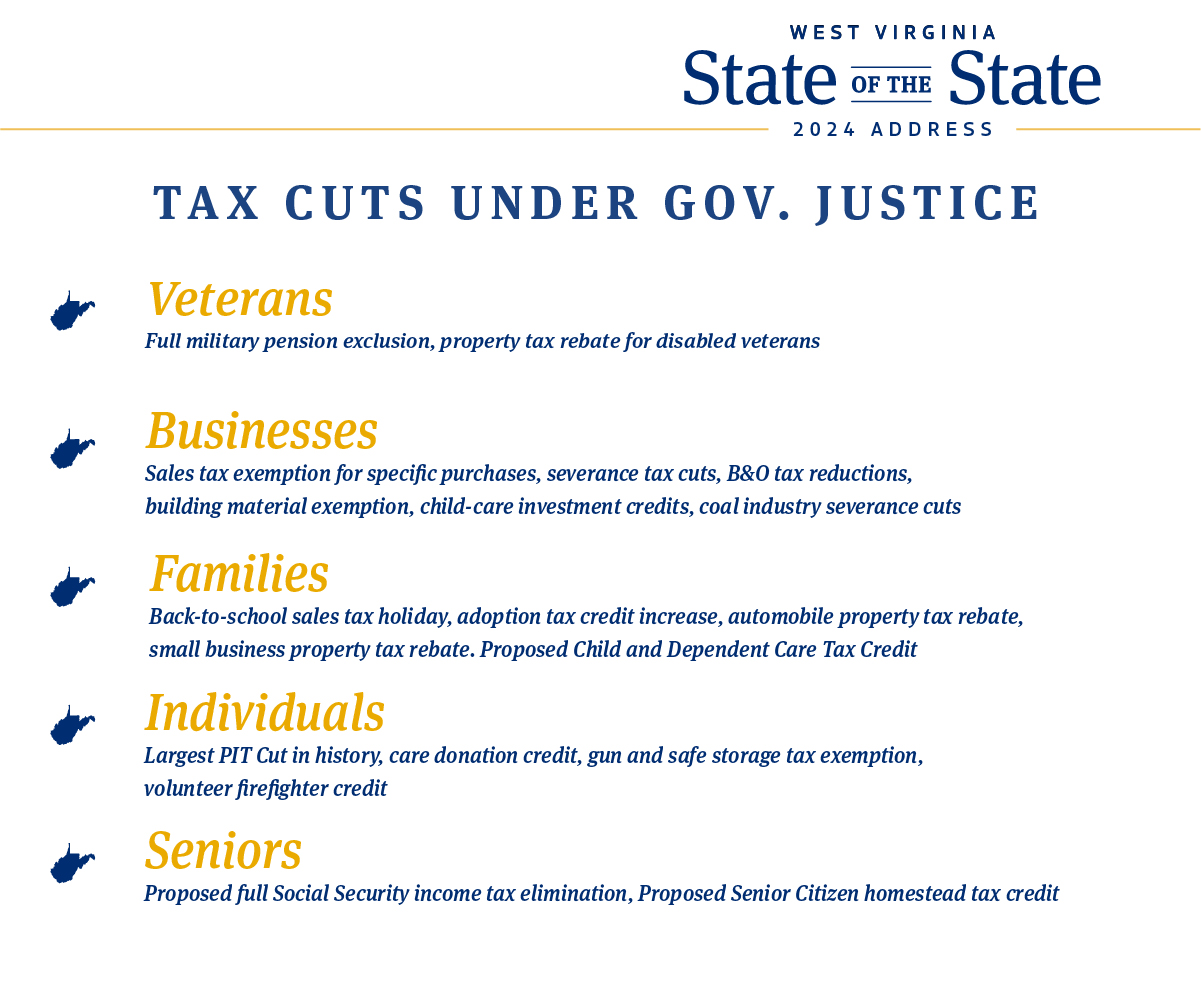

Governor Jim Justice on X: “We’ve cut taxes 23 times since I took

Source : twitter.com

Social Security COLA 2024: Have You Received Your First Increased

Source : www.cnet.com

State Child Tax Credit 2024: what states are making payments this

Source : www.marca.com

Do Social Security Recipients Have to File a Tax Return in 2024

Source : www.cnet.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Child Tax Credit 2024 Requirements: Are there new requirements to

Source : www.marca.com

New Tax Credit For Children 2024 Social Security Child Tax Credit Definition: How It Works and How to Claim It: The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)